I guess my rude email triggered an audit of all my information with them. And I had an apologetic phone call on Monday. This was from the Tax Credits office. The woman gave me the number to self-assessment and the tax office because it isn't just one thing that is messed up, it is all of them.

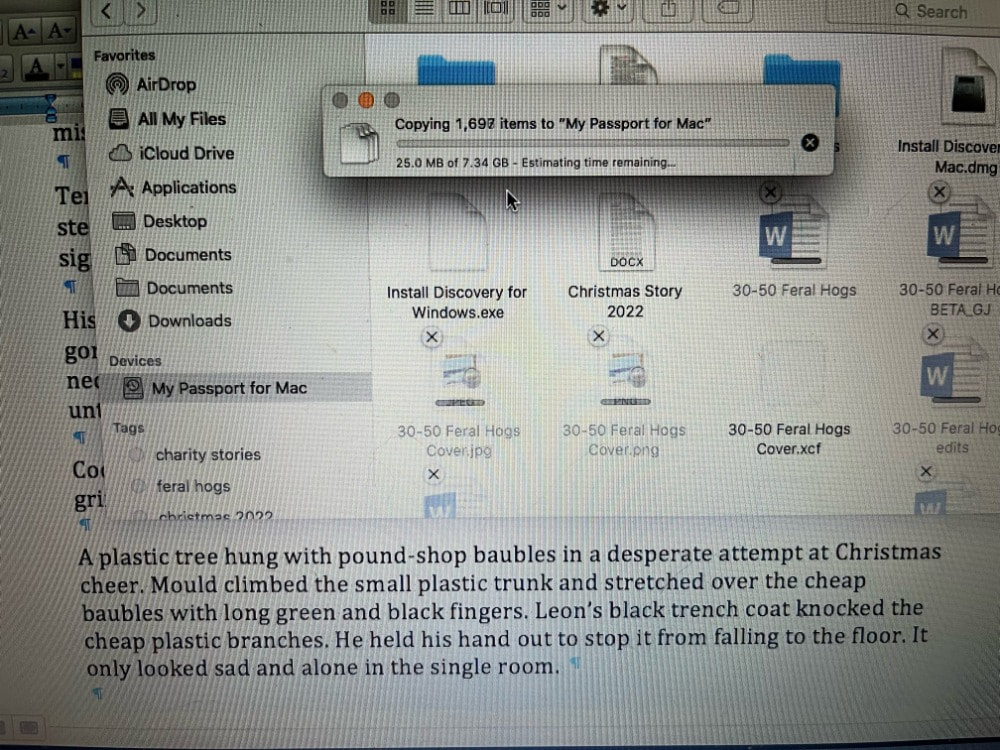

Payment of money they owed to me arrived on Thursday (or at least some, due to the stress costing work, Inland Revenue have been mentioned in that giant fucking dossier of shit that has cost me work, I wouldn't be surprised if they are still holding money from previous tax years and all of that will be uncovered when I go to sort out that particular problem). I used it to purchased a refurbished MacBook Air (a 2017 model, I'm moving up in the world - please note, that is British sarcasm). I had to take a day off because my laptop that wasn't meant to be here until today arrived yesterday (I was at work on Thursday when the notification arrived and swore and everyone knew of my computer problems because I've been going to work with a mild but miserable non-COVID cold all week because I had no means to work at home).

Once the new laptop arrived, I used the time to call the tax office about my tax code. I've been trying to update this since May online. First call I was on hold for 50 minutes plus before it cut off. Second one was 5 minutes before it cut off. Finally, after 45 minutes on hold, the call went through. They try giving me the lecture about doing it online, which i've been trying to do. Turns out, they had me down as being on Job Seekers Allowance despite filling in self-assessment returns every single effing year for years now and having Working Tax Credits (which you don't get without working or earning above a certain amount self-employed, Job Seekers Allowance is for when you are unemployed but employable). They even asked me if I was sure I wasn't on any Department of Work and Pensions benefits (I'm sure, I'm very sure as it says in my goddamn self-assessment forms every single fucking year).

I had called them in the weeks before I started as a full time employee to check everything was right. Way back when I was trying to set up my business for the third time (about 2014) I had similar problems with the Tax Credits office claiming I owed them money but that was before legal changes (and now I'm wondering how much pointless stress I was put through in addition to the asshats around me and how much money they took off me when I didn't owe them anything). They fucking said everything was fine. Clearly it wasn't.

Since May (when I filed my self-assessment) I've been trying to claim back taxes they owe me. This is meant to be done online. It obviously hasn't let me because if it did, I would have my money now. When my tax code was hopefully changed and they removed Job Seekers Allowance from my account, they transferred me to self-assessment who couldn't tell me what went wrong, but I should have that money before the end of November.

How badly can you fuck up? This has really messed with my life over the past 13 years. So in addition to all the personal problems I've had with the people around me not letting me work, Inland Revenue have been making things worse and causing more stress and poverty, and of course, because the people around me weren't letting me look after myself, I couldn't even try to sort any of this out (although I did try to the best of my abilities at the time, bare in mind, you can't think straight with constant stress, in fact, I still have no short term memory and I'm unlikely to recover that, my diagnosis is of the permanent variety - hence the diaries and planners and calendars and post it notes).

Hopefully, everything will be sorted out by the end of November. However, that does leave things pretty hopeless this month. Monday's pay will be taxed on the old code and I'm not sure of how much my tax credit entitlement is. If anyone wants to buy me a Ko-Fi, the next three weeks are the weeks in which to do it (provided everything is sorted now, if it isn't, I'm going to be reduced to living off handouts for god knows how long).

Which does bring me to my next point, I will not be cancelling my salon appointment. After all this stress, I need it. Once all my money is in my account, I will book in for a much needed massage. I know there are memes that circulate about selfcare being scary and sitting with yourself, I don't often talk about those things, because you can't physically see them, but sometimes it isn't scary and rather enjoyable. Self care is about being the best possible you and being comfortable in being that person (and for me, that means nice nails and my hair being as nice as possible for someone with my rather difficult hair texture). Only then can you shine and help others in your own special way. And sometimes, that is a salon appointment.

I keep telling myself I lived through the recession with a baby and a baby-daddy that stole all my money and worked up a ton of debt in my name. I can live through the next few weeks with some careful budgeting (even if I am still going to the salon next week).

And there's Jerk Face "helping" the file transfer with the new laptop.

PS. The Inland Revenue can audit you any time they want without you knowing. It is not illegal for them to do so. In fact, the Tax Credit office can legally spy on you as can the DWP, so if you say you are single, you better fucking be single. It is always best to obey the laws, even annoying tax laws and benefit laws. In my case, it has paid off (hopefully, due to their incompetence, I don't know how much faith I have in the rest of my money showing up).

RSS Feed

RSS Feed